vermont income tax withholding

February 25 2021 Effective. It will increase from 846 to 860 per hour.

Personal Income Tax Department Of Taxes

2017-2018 Income Tax Withholding Instructions Tables and Charts.

. If youre a single filer with 40950 or below in annual taxable income youll pay the lowest state income tax rate in Vermont at 335. Comprehensive website design and hosting complete with tools created especially for CPAs. The states top tax rate is 875 but it only applies to single filers making more than 206950 and joint filers making more than 251950 in taxable income.

The income tax withholding for the State of Vermont includes the following changes. A good source for national and world news. The annual amount per allowance has changed from 4350 to 4400.

Instant Download Mail Paper Copy or Hard Copy Delivery Start and Order Now. The IRS website has many great tax resources for you. The sales tax rate in Vermont is 6.

If your state tax witholdings are greater then the amount of income tax you owe the state of Vermont you will receive an income tax refund check from the government to make up the difference. The Single or Head of Household and Married income tax withholding tables. The employee must send the Form W-4 and statement directly to the IRS office designated on the lock-in letter.

Form W-4 that would decrease federal income tax withholding. Use this site if youve already registered your businessjust log in to your account. Ad The Leading Online Publisher of National and State-specific Legal Documents.

It should take one to three weeks for your refund check to be processed after your income tax return is recieved. Pay Period 04 2021. Establishes a Vermont Business Tax Account Number to report and remit income tax withheld from employee wages pension distributions or other payments subject to Vermont income tax.

For single taxpayers living and working in the state of Vermont. The contribution amounts also are includable in wages for FUTA tax purposes. RateSched-2021pdf 3251 KB File Format.

Comprehensive website design and hosting complete with tools created especially for CPAs. This form is used to determine federal income tax withholding. TAXES 21-10 Vermont State Income Tax Withholding.

Vermont is also increasing their minimum wage effective 112013. A good source for national and world news. The IRS website has many great tax resources for you.

Income tax withholding but Social Security and Medicare taxes normally apply. The Vermont income tax has four tax brackets with a maximum marginal income tax of 875 as of 2022. You must withhold tax in accordance with the lock-in letter as of the date specified in the lock-in letter unless otherwise notified by the IRS.

This form is used to determine federal income tax withholding.

State Corporate Income Tax Rates And Brackets Tax Foundation

How To Report Self Employment Income H R Block

How To Calculate Taxable Income H R Block

State Reports Strong Tax Revenue Results For March Vermont Business Magazine

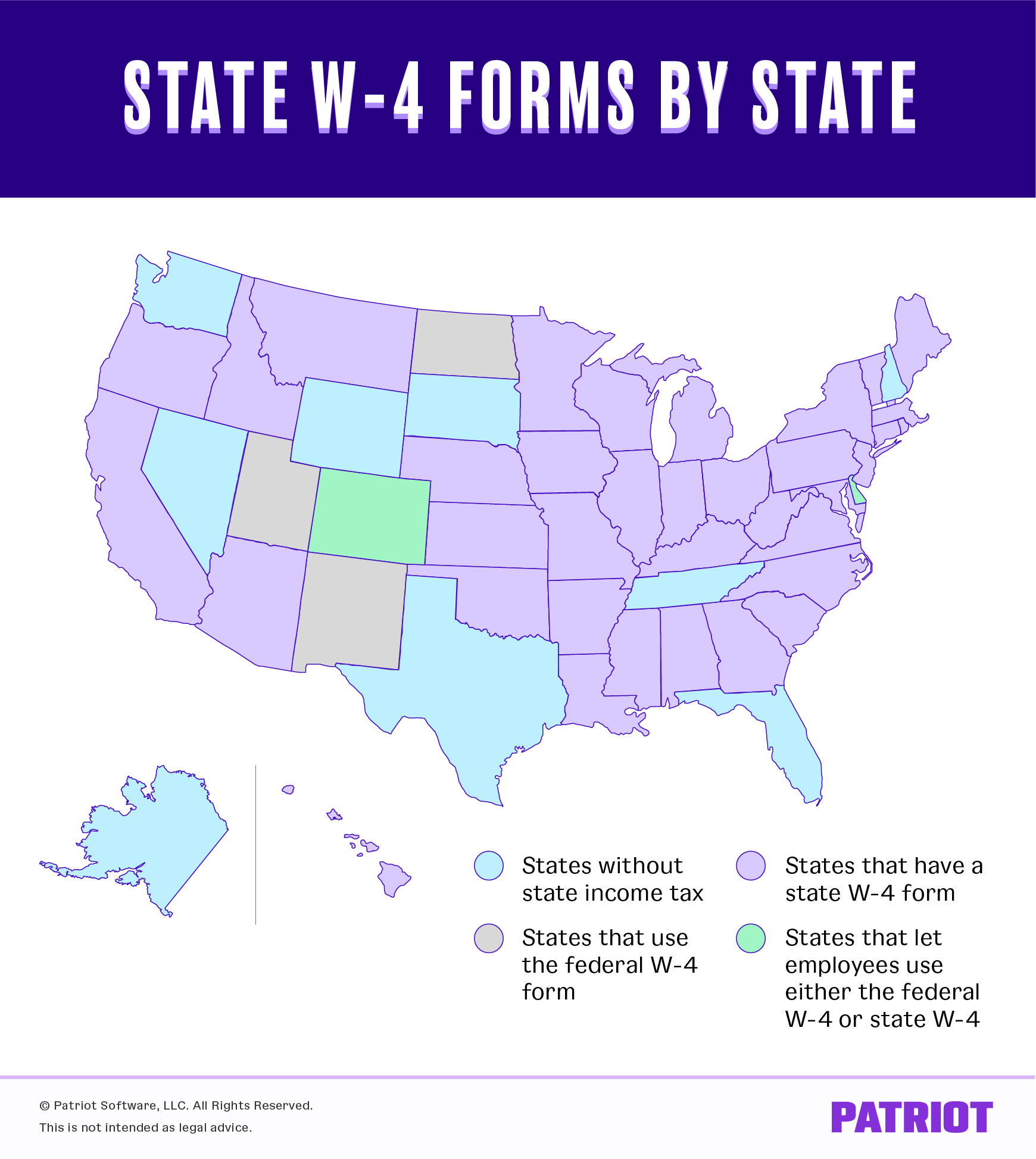

State W 4 Form Detailed Withholding Forms By State Chart

2022 Federal State Payroll Tax Rates For Employers

State W 4 Form Detailed Withholding Forms By State Chart

Lowest Highest Taxed States H R Block Blog

State Income Tax Rates Highest Lowest 2021 Changes

/1065-4a7e2e6cd377480d8309bf645bfc20a4.jpg)

Form 1065 U S Return Of Partnership Income Definition

10 Tax Tips For People Working And Living In Different States Howstuffworks

Personal Income Tax Department Of Taxes

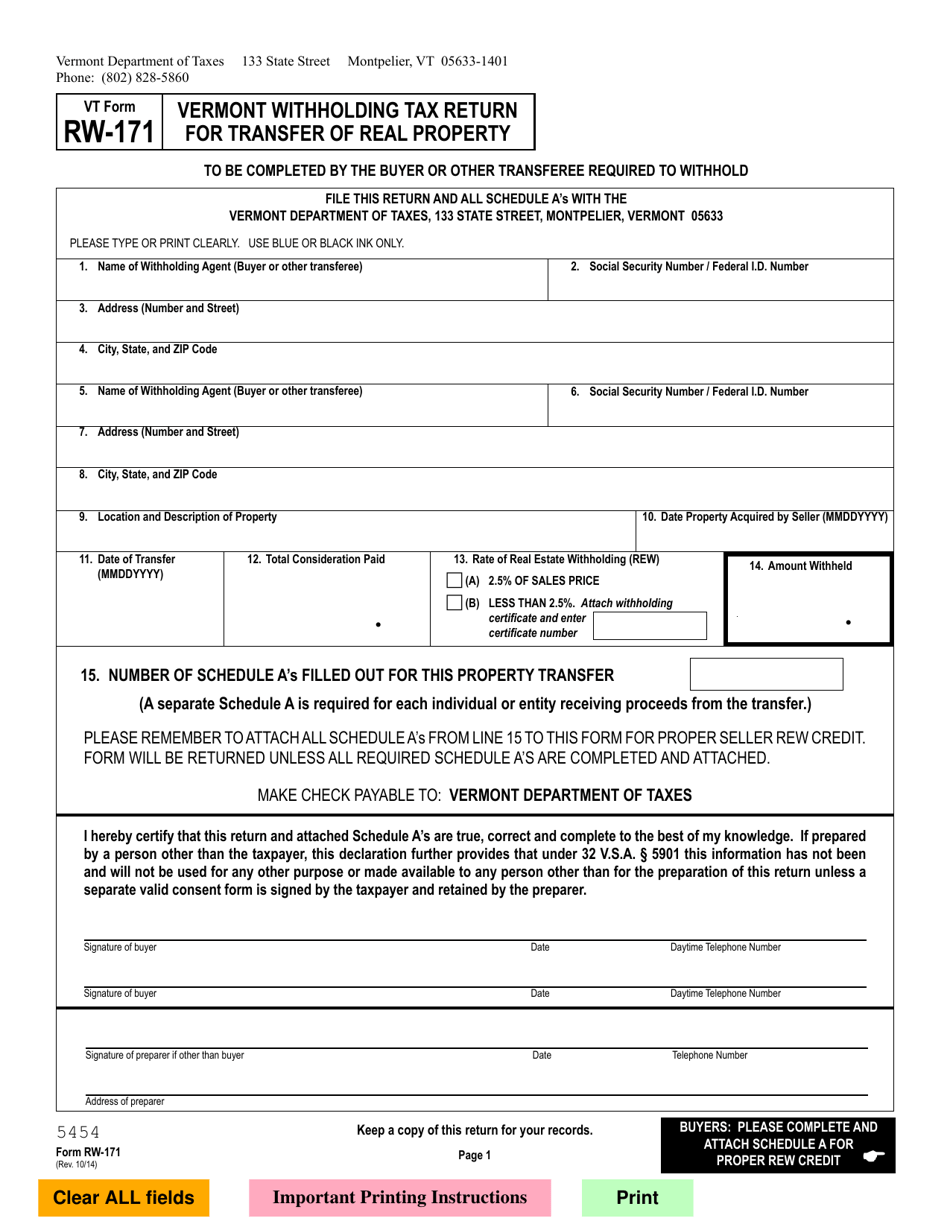

Vt Form Rw 171 Download Fillable Pdf Or Fill Online Vermont Withholding Tax Return For Transfer Of Real Property Vermont Templateroller

State Reports Strong Tax Revenue Results For March Vermont Business Magazine

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub

Beware Know The Red Flags When It Comes To Recognizing A Fraudulent Charity Paula Fleming Was On The Fox 25 Morning School Shootings Morning News New Boston

Vermont Tax Rates Rankings Vermont State Taxes Tax Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)